In the fast-paced world of trading, using the right tools and strategies can make all the difference in achieving consistent profits. GMGN, a leading trading platform, offers a range of powerful indicators and signals to help traders make informed decisions and improve their trading performance. In this article, we will explore how you can use these tools to boost your profits on GMGN.

1. Understanding Indicators and Signals

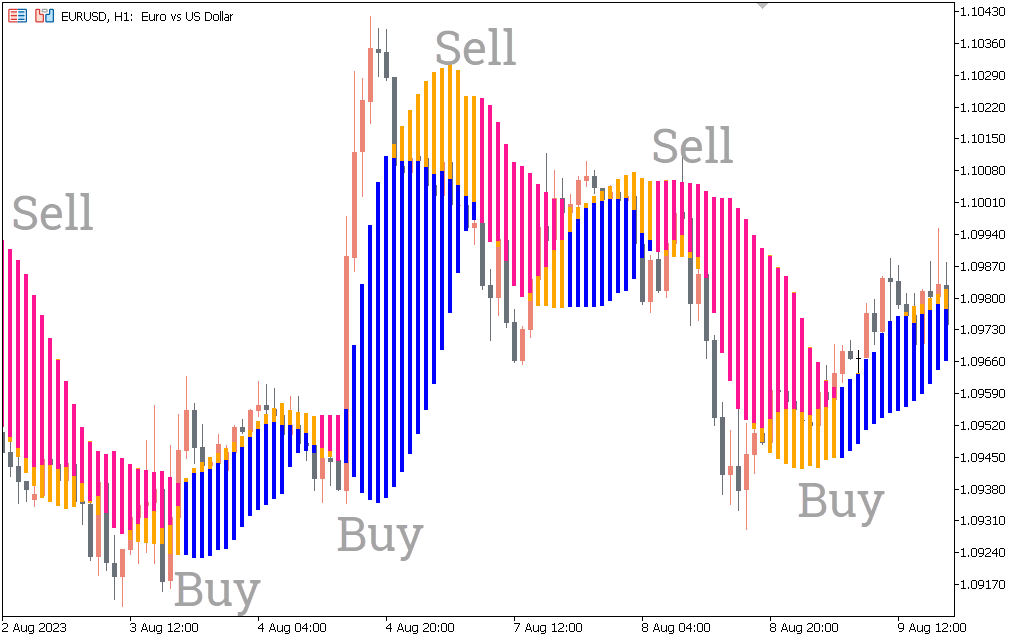

Indicators are tools that help traders analyze market data, identify trends, and make predictions about future price movements. These indicators can be technical, such as moving averages and RSI (Relative Strength Index), or fundamental, based on news and events. Signals, on the other hand, are alerts or recommendations that notify traders when to buy or sell based on specific criteria or patterns.

On GMGN, traders have access to a wide variety of indicators and signals, allowing them to fine-tune their strategies and make better-informed decisions.

To start using these tools, visit GMGN’s broker page: https://stakingy.com/brokers/gmgn

2. Key Indicators for Success

GMGN offers a range of technical indicators that can help traders track price trends and market sentiment. Some of the most popular ones include:

- Moving Averages (MA): Moving averages help smooth out price data and identify the overall trend of a market.

- Relative Strength Index (RSI): The RSI measures the speed and change of price movements to identify overbought or oversold conditions.

- Bollinger Bands: These bands help determine volatility and identify potential price breakout points.

By combining these indicators, traders can develop strategies that align with their trading goals, increasing the chances of making profitable trades.

3. Using Signals to Make Better Trades

Trading signals are essential for those who want to make timely decisions. On GMGN, signals are generated based on complex algorithms that analyze market conditions and provide actionable buy or sell alerts. These signals can help traders take advantage of short-term price fluctuations and capitalize on market trends.

The advantage of using signals is that they save time and effort by automatically scanning the market and suggesting opportunities. Whether you’re a beginner or an experienced trader, these signals can enhance your strategy and help you make more informed decisions.

For more details on GMGN’s signals, visit this link: https://gmgn.ai/?ref=FKNvP6Qi&chain=sol

4. Combining Indicators and Signals for Maximum Profit

While each indicator and signal can be useful on its own, the real power comes from combining them. By using multiple indicators and relying on signals for timely execution, traders can build a robust strategy that maximizes profit potential. For example, using a moving average alongside RSI can help confirm trends, while Bollinger Bands can provide insights into market volatility.

GMGN’s platform allows you to customize and combine different indicators and signals according to your preferences, making it easier to implement a strategy that works best for you.

5. Why GMGN is the Right Platform for Traders

GMGN stands out in the crowded trading market because of its comprehensive tools, ease of use, and user-friendly interface. The platform integrates advanced indicators and signals, helping traders at every level make smarter, more profitable decisions.

With its powerful features, GMGN empowers traders to analyze the market, spot opportunities, and execute trades with precision. Whether you’re looking to improve your day trading or long-term strategies, GMGN provides the resources to help you succeed.

Using indicators and signals on GMGN is a great way to enhance your trading strategy and increase your chances of making profitable trades. By understanding how these tools work and leveraging them effectively, traders can make more informed decisions, reduce risk, and boost profits. Start utilizing GMGN’s powerful tools today and take your trading to the next level.